Executive Summary

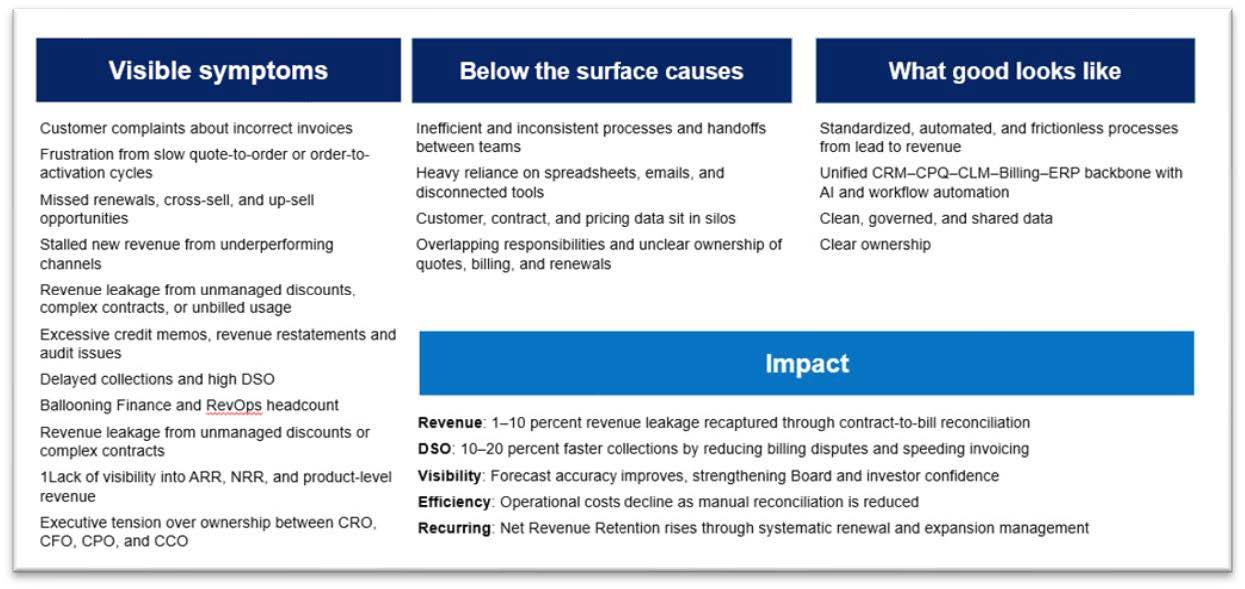

Private-equity-backed companies often leave significant value trapped inside their Lead-to-Cash (L2C) process, the sequence that turns leads into invoices and invoices into cash. Inefficiencies here don’t just cause operational pain; they erode margins, delay cash flow, and distort visibility into performance.

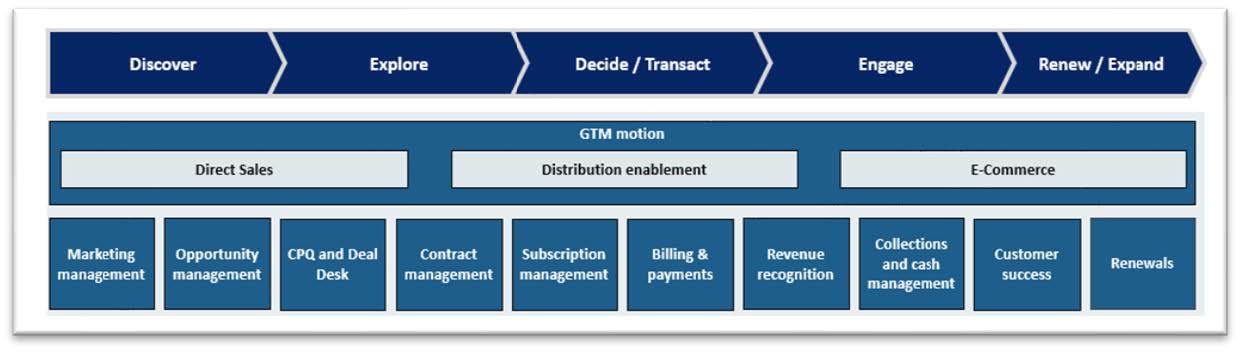

Lead-to-Cash spans Marketing, Sales, Product, Customer Office, and Finance. It governs how opportunities become orders, how orders become revenue, and how revenue becomes cash. When this process is fragmented, it creates revenue leakage, inaccurate forecasts, and working-capital inefficiency. When orchestrated well, it drives cleaner revenue, faster cash, and stronger EBITDA.

Fixing Lead-to-Cash is not about implementing new tools. It is about building an integrated operating model where people, processes, and data work in harmony across functions, creating a unified, efficient, and transparent revenue engine that scales with confidence.

Lead to cash is the core process across multiple functions and capabilities

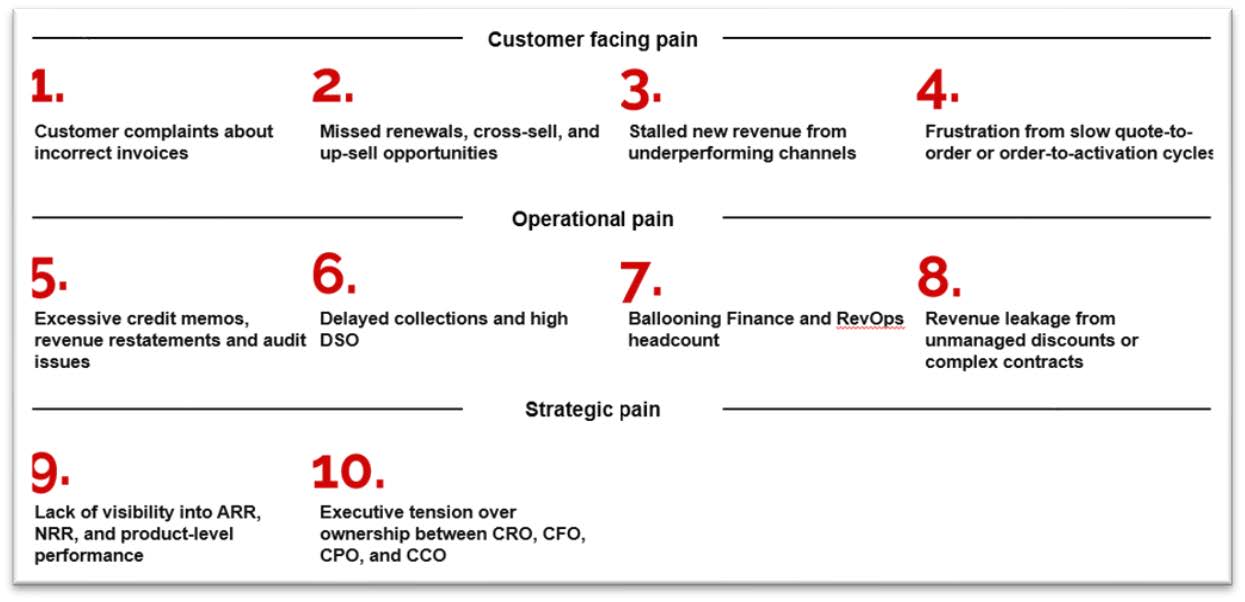

1. The 10 Lead-to-Cash Symptoms

When Lead-to-Cash is not working, the cracks are obvious to customers, employees, and Boards. They start small, an invoice dispute here or a renewal delay there, but they compound quickly. Sales forecasts drift from actuals, collections slow down, and Finance scrambles to reconcile data that never quite ties out.

These issues rarely stem from a single point of failure. They emerge when the multiple functions that share the Lead-to-Cash process operate with different systems, data, and definitions of success. What begins as local inefficiency becomes a structural drag on growth, profitability, and credibility.

We group these into 10 common symptoms that signal trapped value in the Lead-to-Cash process:

Customer-Facing Pain

1. Customer complaints about incorrect or delayed invoices

2. Frustration from slow quote-to-order or order-to-activation cycles

3. Missed renewals, cross-sell, and up-sell opportunities

4. Stalled new revenue from underperforming channels

Operational Pain

5. Revenue leakage from unmanaged discounts, complex contracts, or unbilled usage

6. Excessive credit memos and revenue restatements

7. Delayed collections and high DSO

8. Audit issues requiring corrections and compliance rework, often driving extra Finance or RevOps effort

Strategic Pain

9. Forecast inaccuracy and poor visibility into ARR, NRR, and product-level performance

10. Executive tension and misalignment over ownership and accountability

These issues tend to appear as companies scale past $50 million in revenue. A B2B SaaS company in the philanthropic sector experienced late renewals, billing disputes, and heavy manual reporting that left leaders with inconsistent ARR forecasts. These challenges did not just frustrate the Finance team, they reached the Boardroom, eroding confidence in the company’s growth story.

Recognizing these symptoms is the first step. They are visible indicators that the business’s Lead-to-Cash process is not operating as a unified system and that meaningful value is trapped below the surface

Business symptoms of Lead-to-Cash pain

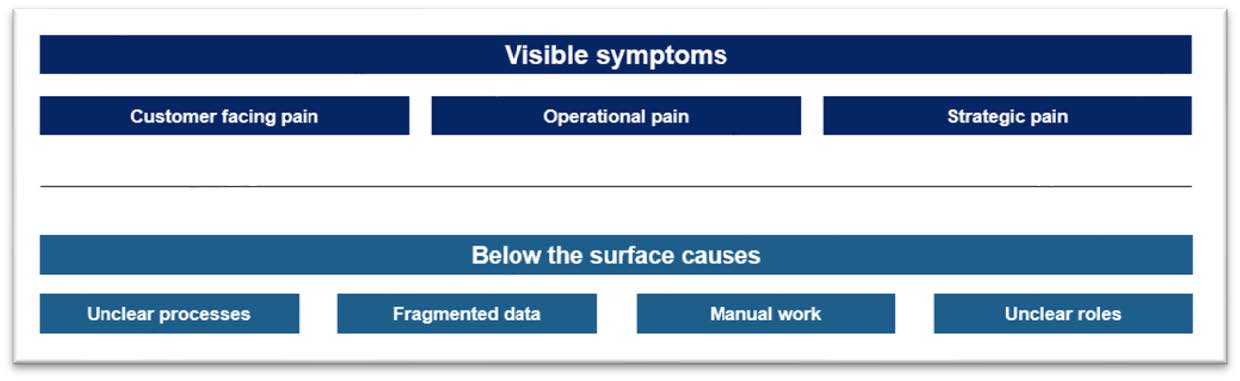

2. Root Causes of Misalignment

While the ten symptoms describe what the business feels, and what customers and Boards see, the real causes lie beneath the surface. These are not perception problems; they are structural weaknesses in how work gets done day to day.

The visible pain, slow billing, missed renewals, inconsistent forecasts, stems from deeper operational gaps such as disconnected systems, unclear processes, and fragmented ownership. Across dozens of PE-backed companies, the same underlying forces appear again and again:

- Unclear processes create inconsistent handoffs and rework across teams.

- Manual work and tech debt result from overreliance on spreadsheets and disconnected tools.

- Fragmented data means no single view of customers, contracts, or pricing.

- Unclear accountability leaves no one truly responsible for handoffs between quote, billing, and renewal.

A global SaaS provider in compliance and audit software illustrates this. Despite running Salesforce and NetSuite, its sales forecasts and revenue recognition diverged. Quotes required manual approvals, Finance had to rework contracts, and there was no RevOps owner for the process. The result was preventable friction, missed forecasts, and an overstretched Finance team.

These conditions cannot be solved with surface-level fixes. The problem lies in the absence of process discipline, data coherence, and role clarity, the foundations required for a healthy Lead-to-Cash system.

Operational root causes are non-visible to organization but drive the above-the-surface pain

3. Strategies for GTM–Finance Integration

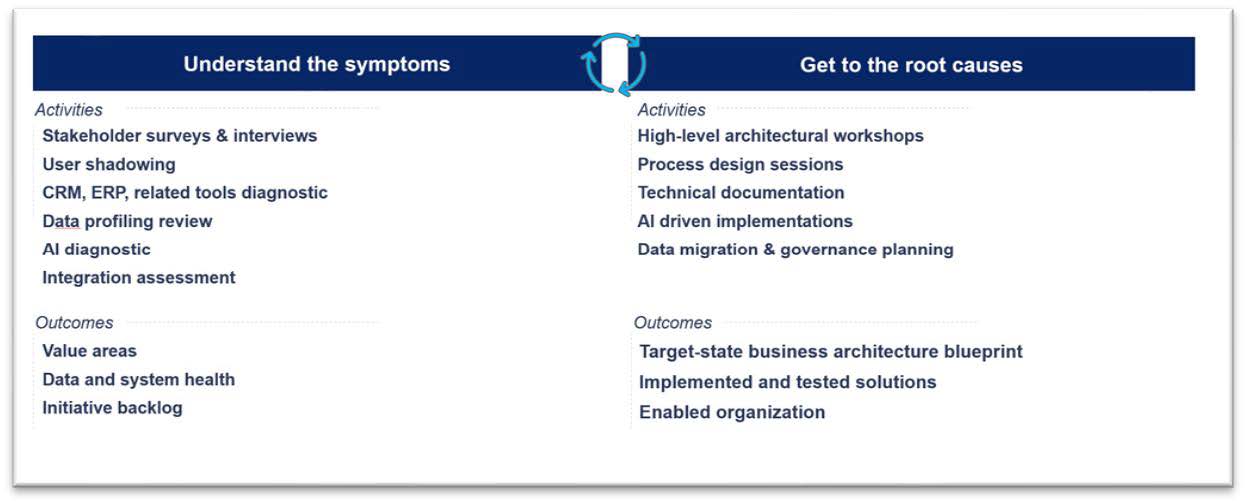

The first step in unlocking trapped value is not technology or governance, it is identifying, sizing, and prioritizing the root causes that create friction across Lead-to-Cash. What once took months of workshops and interviews can now be done in weeks through data-driven methods.

Modern diagnostics combine AI-assisted audits, data profiling, and targeted stakeholder input to separate perception from fact and help leadership focus on what truly matters.

1. Understand the symptoms.

Establish facts before jumping to conclusions:

- Are you leaking revenue? Use audits or AI to check if invoices match sales commitments.

- Are customers frustrated? Track quote-to-order times, billing accuracy, and credit memos.

- Are sellers constrained? Survey Sales, Success, and Renewal teams for operational blockers.

- Are operations bloated? Benchmark Finance and RevOps headcount against peers.

2. Get to the root causes.

Once the surface issues are visible, dig deeper using faster, data-enabled tools:

- Profile data quality and governance using AI-based analytics.

- Trace orders from lead to cash to pinpoint where they stall.

- Assess CRM, CPQ, and ERP configuration for coverage and automation gaps.

- Review reporting, if it is not tracked, it is not managed.

- Talk to people, interviews often surface the most practical insights.

A payments software provider applied this approach, using AI to map its quote-to-bill process in weeks instead of months. It found that 28% of delayed invoices stemmed from missing product configurations, easily fixed once identified.

By combining targeted data analysis with focused stakeholder feedback, companies move quickly from “we think” to “we know.” This clarity enables high-impact improvements that eliminate friction, accelerate cash, and release trapped value across the entire Lead-to-Cash process.

Fast assessment and related value capture sprints

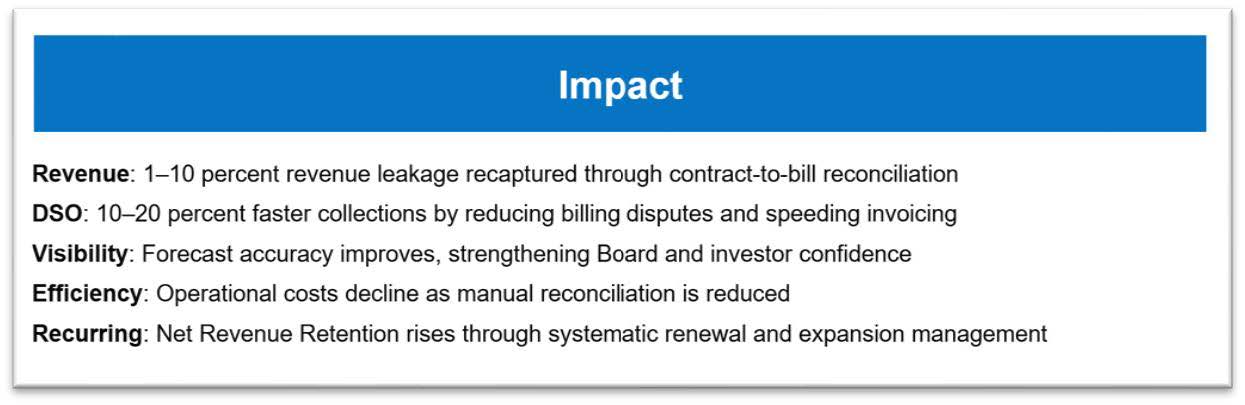

4. Real-World Impact. What Good Looks Like

When Lead-to-Cash operates as a single, orchestrated system, the results are both financial and operational:

- 1–3 percent of revenue leakage recaptured through contract-to-bill reconciliation

- 10–20 percent faster collections by reducing billing disputes and speeding invoicing

- Forecast accuracy improves, strengthening Board and investor confidence

- Operational costs decline as manual reconciliation is reduced

- Net Revenue Retention rises through systematic renewal and expansion management

A supply-chain risk-management platform achieved this transformation by automating billing and implementing CPQ. The company reduced billing disputes, improved forecast visibility, and gave Finance and Sales a shared data foundation. Days Sales Outstanding dropped, freeing working capital for reinvestment.

Beyond financial gains, companies that execute Lead-to-Cash flawlessly share a common set of operational traits:

- Processes: Standardized, automated, and frictionless from lead to revenue.

- Technology: Unified CRM, CPQ, CLM, Billing, and ERP backbone with AI and workflow automation.

- Data: Clean, governed, and shared, providing one version of truth across bookings, billings, and cash.

- Roles: Clear ownership and accountability across Sales, Product, Customer Office, and Finance.

When Lead-to-Cash reaches this level of maturity, it stops being a source of friction and becomes a strategic asset, powering growth, resilience, and investor confidence.

Lead-to-cash unleashes real value to the P&L

Conclusion

The largest source of trapped value in growing companies is the inefficiency buried within the Lead-to-Cash process.

Fragmented workflows create leakage, churn, and inefficiency. Orchestrated Lead-to-Cash systems deliver clean revenue, faster cash, and stronger EBITDA.

Businesses that modernize and integrate their Lead-to-Cash processes, aligning people, data, and systems around a single operational backbone, can rapidly unlock trapped value and accelerate profitable growth.

Lead-to-cash improvement brings true financial impact to PE backed businesses